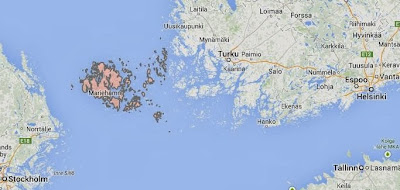

Belize is located on the northeastern coast of Central America. It is the only country in the area where English is the official language and it is bordered on the north by Mexico, to the south and west by Guatemala and to the east by the Caribbean Sea.

Corporate tax: 25%

Gambling tax: 35%

Fees: USD $10,000

Belize Finance Information:

The International Business Company Legislation was enacted in Belize in the early 1990’s, together with a range of other offshore laws. That led to growth of interest in Belize as a low-tax jurisdiction. More than 3 000 IBC’s were registered in Belize from 1990 to 1997, under the Companies Act of 1990 which is based on modern corporate legislation giving extended privileges and absolute confidentiality. The Belize IBC Act is worked out based on the best features of legislation adopted in other jurisdictions offering offshore incorporation.

Offshore jurisdiction ratings issued by Swiss company Guaranty Trust Ltd and compiled by many criteria including banking secrecy, legal system, and communications and tax regime, put Belize at the top of its list.

Who manages E-Gambling in Belize:

Belize’s Computer Wagering Licensing Act, 1995, which was introduced in May 1996, provides for the proper conduct and regulation of gambling via the Internet. The Act also provides for the licensing of computer services operators who provide computer Internet users with the facility to wager against each other on sporting events or other games of chance. The Belize Computer Wagering Licensing Board is responsible for all applications for licenses to provide computer wagering services and has the authority to grant exclusive licenses. They also control and regulate all persons who provide computer wagering services. Online gaming licenses may be issued to businesses incorporated in Belize by the Online Gaming Licensing Committee, operating under the authority of the “Gaming Control (Online Gaming)

Brief History:

In 2004, the Prime Minister signed a Statutory Instrument adjusting the Online Gaming Regime to make processing and monitoring more efficient and to reduce licensing fees from USD 50,000 to USD 15,000.

For a non-exclusive license. Under the original legislation, licensees were required to make a cash deposit of USD 500,000 as security for the performance of obligations. This requirement has since been modified significantly.

A license is required to conduct gaming from within Belize and gaming business (wagering) cannot be conducted with Belize residents.

One license can be held at any one time and only persons with integrity, competence, and adequate financial means.

Licensees need a separate bank account for processing wagers and may charge a processing fee up to 5 percent of each transaction or the sum of USD 20, whichever is greater.

A 15 percent withholding tax on payments of prizes is implemented by holders of wagering licenses. Annual Licenses expire on March 31 regardless of the issuance date.

In August, 2007 the government of Belize released a statement warning of clandestine companies claiming to have been licensed in Belize when, in fact, Fulton Data Processing Limited and Bwin Intercontinental Limited were the only two operators licensed there.

Minimum Share Capital for an iGaming Company:

There is no minimum share capital authorized in Belize. If there is no share capital, fees are charged according to the number of members.

Security Requirements / Indemnity for Player Deposits:

All license holders are required to maintain security deposits and reserves within the Central Bank of Belize that can be drawn on for the purposes of any debt repayment associated with the enterprise’s online gambling activities. The Belizean Online Gaming Licensing Committee must be informed if the enterprise requires these deposits and reserves at any point and must then follow the Committees recommendations.

Belize Gambling License Fee:

Licenses are valid for 12 months, and require a USD $10,000 initial payment and USD $10,000 annual renewal fee. Online gaming sites licensed in Belize may not accept wagers from residents of Belize.

License Length:

One year

Anti-Money Laundering Policy:

The Money Laundering (Prevention) Act of 1996 creates specific procedures and standards that, when adhered to, will ensure that The BOSL Group, and the financial services industry in Belize in general, remain free of tainted funds and other assets.

Resolution of Complaints and Disputes:

There is no documented official complaints or dispute resolution process available for players in a dispute with a casino licensed in Belize. In such cases players are totally at the mercy of the honesty of the operator,

Belize Restrictions:

Anyone intending to conduct online gaming in Belize must be licensed by the Gaming control board. The conditions of the license prohibit the online gaming operator from accepting bets from any person resident within Belize.

Contact Details:

Belize Gaming Control Board

Address:

New Administration Building

Belmopan, Cayo

Belize

Website: www.belize.gov.bz

Online casinos licensed in Belize:

4XP

All Poker Games

Amazing Video Poker

Carib Sports Off Shore

Casino Grande

Casino Mel

Casino Poker Las Vegas

EasyXP

Finopex

Forex Metal

ForexBroker Inc

Jeux de Cesar

Lotto London

Lucky Gate Casino

Maximus Casino

Online Casino Fever

Opteck

Option Ground

Rockland Casino

Royal City Casino

Russian Casino

Sizzling Slots

Video Poker Classic Casino

Video Poker Saloon

To read more about other online Gambling Jurisdictions click here.