Lucky Streak Live

Founded in 2014, Lucky Streak Live has already established itself as a leading B2B provider of casino gaming solutions for both web and mobile platforms.

Games are designed with a entertainment first approach, promising to provide a gaming experience that will hook players and keep them engaged.

Lucky Streak has made it their mission to take take the world of Live Casinos to new heights by merging inovation, gamification and style into one unforgetabble experience.

Lucky Streak Software and Technology

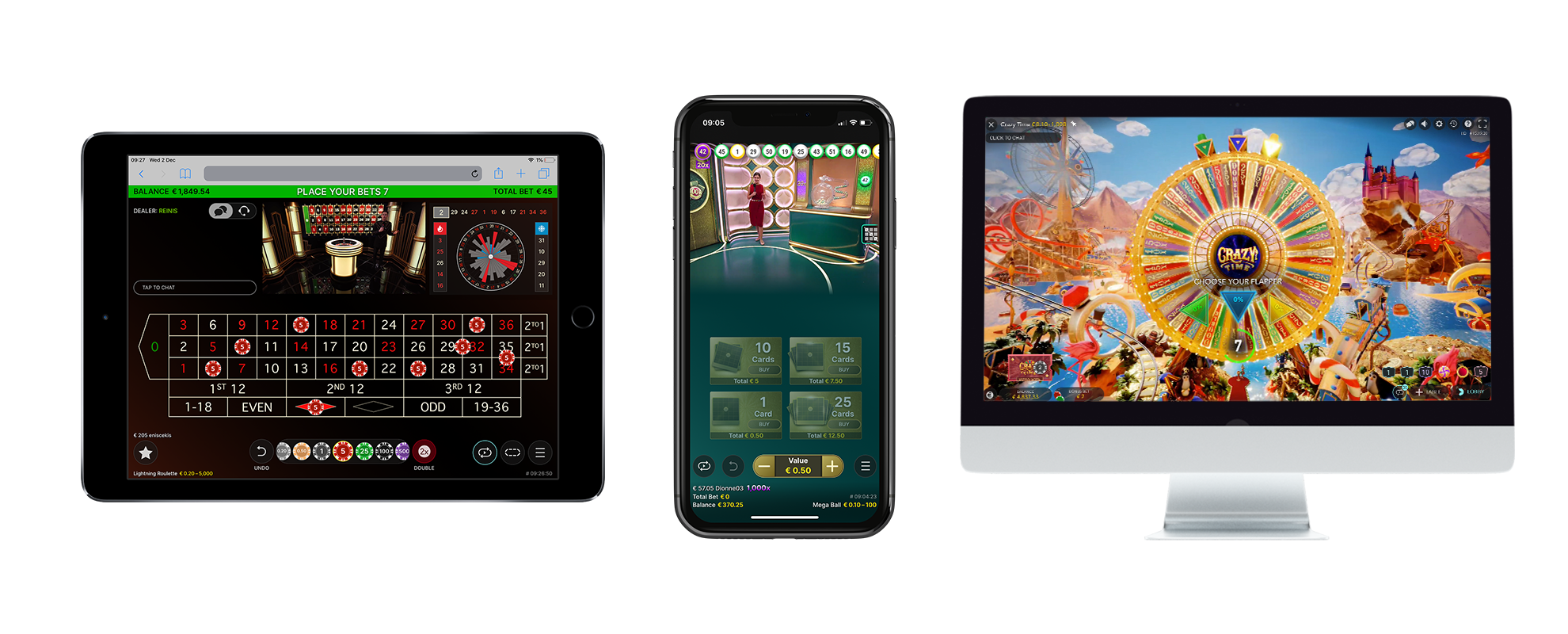

The Lucky Streak Platform provides a number of casino games. Their most popular being their live games: BlackJack, Baccarat, European Roulette and Auto Roulette.

Streams of each game have been optimized to deliver real-time videos directly to players in high definition. Additionally, their cross-platform clients detect device and bandwidth constraints and adjust video streams accordingly. Thus providing players with the best experience available

buy Lurasidone for veterinary use Key Features :

- A newly built gaming studio using state-of-the-art network and video hardware

- Superior video quality and advanced in-house video broadcasting solutions

- An HTML5 user-friendly interface based on extensive user behaviour and user experience research

- A highly localized multilingual user interface with 12 supported languages

- 24/7 Live Customer Support

Live Games

Live Games are the very foundation that Luckystreak was built on. The software provider has an array of live dealer table games including roulette, baccarat and blackjack.

Roulette

Lucky Streak’s unique design coupled with their engaging hosts will have players hooked throughout their gaming experience. And with the option for multiple players to play at the same time, revenue opportunities for operators are plentiful.

The live game can be broadcasted in HD with two camers displaying the game presenters every move as well as every spin of the roulette wheel.

Baccarat

This live version of the popular Asian card game offers gamblers 6 options for side bets thus presenting the players with new betting opportunities. And if that wasn’t enough, Lucky Streak’s Baccarat is equipped with game history. Which is displayed on the screen allowing for easy analysis.

BlackJack

Lucky Streak has enhanced and refined one of the most played casino games around. Their Live BlackJack ensures a high energy game and entertainment for both casual players and high rollers. It has a number of features guarenteed to hook olayers from the start

Third Party RNG game providers

While live table games are LuckyStreak’s most sought after games, they also provide a number of third party RNG games provided by popular game providers, namely:

- Pragmatic Play – Slots

- Spinomenal – Slots

- Hacksaw Gaming – Scratch Cards

- BGaming – Slots

- Tom Horn – Slots

- Fugaso – Slots

- Betsoft – Slots